This article is part of a larger series on Business Banking.

TABLE OF CONTENTSA business bank statement is a document that shows the transactions you made within a specific period. Typically, it covers one month and contains information about your business checking or savings account. Transaction details are listed in the statement, displaying your deposits and withdrawals, including purchases made using the business account’s debit card.

Key takeaways

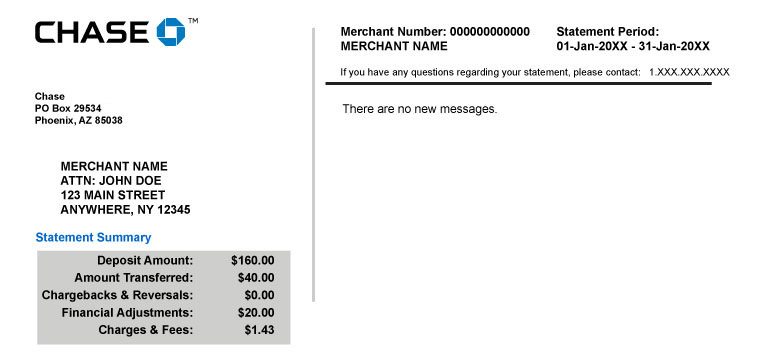

Business bank statements vary for every financial institution, but you can find similar information from all of them. Below is a business bank statement sample that you can review to familiarize yourself with the different parts.

The statement below is for a merchant account with Chase. Your business checking statement may not include every section listed.

Sample bank statement from Chase (Source: Chase)

When you open your bank statement, you may see the following information.

This section includes the financial institution’s name, address, contact details, website address, and phone number. In the business bank statement example above, you can find Chase’s bank information on the upper left side of the page.

This contains details about your business name, address, and contact number. In this example, you can find your business information right below Chase’s bank information.

The section covers the type of account you opened with the bank, which includes the business account name and number. The account information in this example is found on the upper right side of the page.

This will tell you the specific date range of the bank statement. In this case, the statement period is from January 1, 20xx to January 31, 20xx.

The section displays your account’s beginning and ending balance, including the total deposits (credits) and withdrawals (debits) made for a particular statement period. Generally, the account summary is found at the top of the bank statement after the account information.

In our business bank statement example, the account summary is referred to as a statement summary. We can find the total amount of the deposits, transfers, chargebacks and reversals, financial adjustments, and charges and fees.

This lists each transaction you made within the statement period. It will occupy the most space in a bank statement. The transactions are listed in chronological order and will include the date, transaction description, reference codes, transaction amount, and balance after the transaction. The transaction description will often provide detailed information on the type of transaction you made.

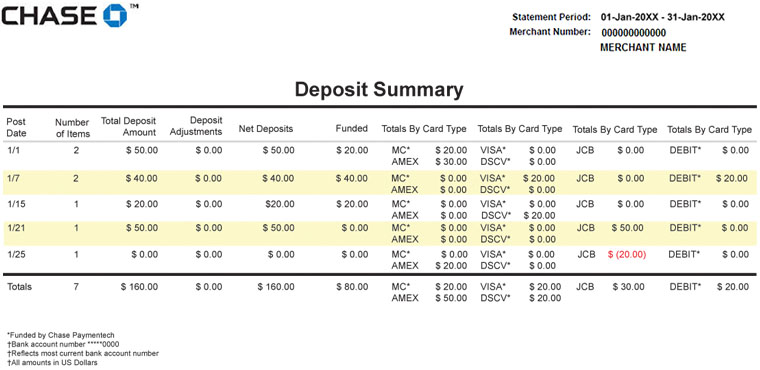

From the example below, you can see the deposit summary, funding summary, and credit card summary sections. Under the deposit summary, a record of all your deposit transactions per card type can be seen. You can also view the different deposit amounts made per transaction date, including the item number, deposit adjustments, and net deposits.

Sample deposit summary from Chase (Source: Chase)

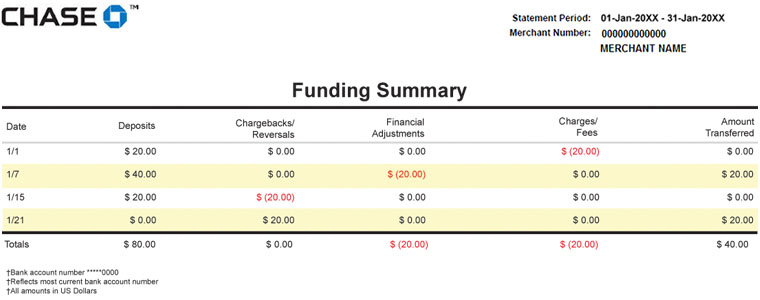

In the funding summary section below, you can view the transaction date, deposit amount, chargebacks and reversals, financial adjustments, charges and fees, and transferred amounts.

Sample funding summary from Chase (Source: Chase)

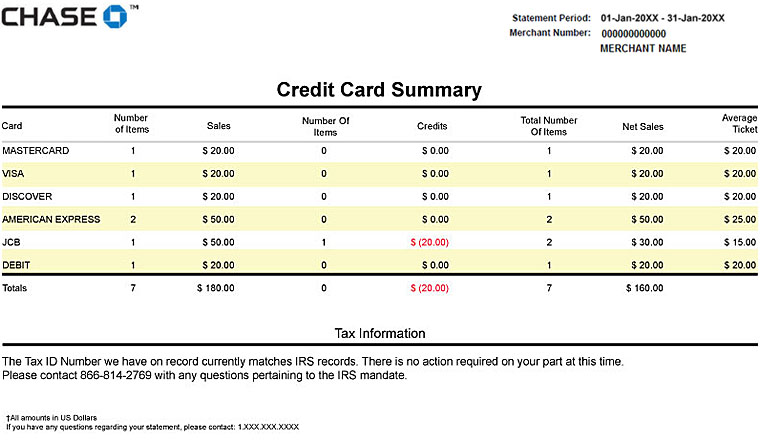

The credit card summary section below displays information that includes the breakdown of sales per card type, sales amount, number of items, credits, and net sales.

Sample credit card summary from Chase (Source: Chase)

These can be included by some financial institutions, where news and important reminders are announced.

Business bank statements will vary for each bank. It is best to contact your business banking representative if you have further questions about the details of your statement.

You can access your business account bank statements in two ways. Financial institutions send a statement each month in paper or electronic form:

Related resources:

Yes, business bank statements can be presented as proof of income if they show the regular payments made by customers, as bank statements provide information on the income and payment history of the business. However, in most cases, you will need tax documents as well for proof of income.

What is the easiest way to get bank statements?The easiest way to obtain bank statements is by logging into your online account and downloading the statement. If you sign up for paperless banking, you can get notifications of when your new statement is ready for viewing. Some banks will mail you monthly statements, although there can be a fee for this service.

What is the difference between a bank statement and an account statement?Bank statements contain a list of the user’s banking transactions and are sent by a financial provider. Meanwhile, account statements summarize the purchases and payments between businesses and are sent by another company.

What bank statements do lenders ask for?Typically, lenders request business checking and savings account bank statements from loan applicants. You will usually need annual tax and profit and loss statements as well.

Do businesses need to keep bank statements?Yes, keeping a record of business bank statements helps you provide accurate information to lenders if you apply for financing. It will also help you assess your business performance, plan your budget, generate financial reports, and comply with tax return filing.

If you are a small business owner, business bank statements can help you gauge your past performance, conduct a financial forecast, and determine how much you spend and save to manage your business spending better. Further, they allow you to detect fraud early and accomplish lender requirements when applying for loans.